What are the different valuation methods of companies?

Valuation methods are essential questions in M&A interviews. From a simple question "What are the valuation methods that a company can use?" to "Tell me all you know about the DCF method", any excuse is good to talk about valuation methods.

We will therefore quickly present the most commonly used methods and how they work.

Read more: How to maximize your chances of getting an M&A internship?

The Comparable Analysis

The Comparable Analysis method is widely used for unlisted companies. It consists in finding out about previous transactions that are similar to the one you want to make. There are two steps to follow:

- Identify comparable transactions in terms of sector of activity, size and geographical area

- Apply the multiples used in these transactions to the company you are selling

The disadvantage of this method is that it is difficult, if not impossible, to find similar transactions. Indeed, depending on the sector of activity and geographical area, it may be impossible to find several comparable financial transactions.

The DCF (Discounted Cash-Flow) method

The DCF (Discounted Cash-Flow) method is certainly the most requested method in interviews, as it can lead to practical cases. If you are asked in an interview to quickly develop a DCF, the following steps should be followed:

- Calculation of the Free Cash-Flow to Firm from year N to N+5 with the following formula: FCFF = EBIT x (1 - tax rate) + D&A - Changes in NWC - CAPEX

- Calculate the WACC (Weighted Average Cost of Capital) with the following formula: WACC = (Percentage of debt x Cost of debt x (1 - tax rate) ) + Percentage of Equity x Cost of Equity

- Calculate the present value (PV) of the FCFF from year N+1 to N+5 (or 7, depending on the case). To do this, multiply the FCFF calculated for each year by the WACC

- Add up all the values found for the N years and the Terminal Value of the company (total value of the company), independently of its net income each year

The final result corresponds to the valuation of your company. This method has the advantage of being really adapted to your company since it takes into account the Capital Structure (your share of equity and debt) of your company and its entire income statement.

Read more: Focus on a must in interviews: the sell-side process

The Market Analysis

The Market Comparables method is similar to the Comparable Analysis. The only difference is that this method applies to listed companies, while the comparable analysis method applies to unlisted companies. To apply it, the following steps must be followed:

- Identify comparable listed companies in terms of industry, geography and size

- Calculate the multiples used during the valuation. These can be EV (Enterprise Value) / EBITDA, EV / EBIT, EV / Sales or the PER (Price Earning Ratio)

- Apply these multiples to the company you are working on

The Football Field: how to link these methods?

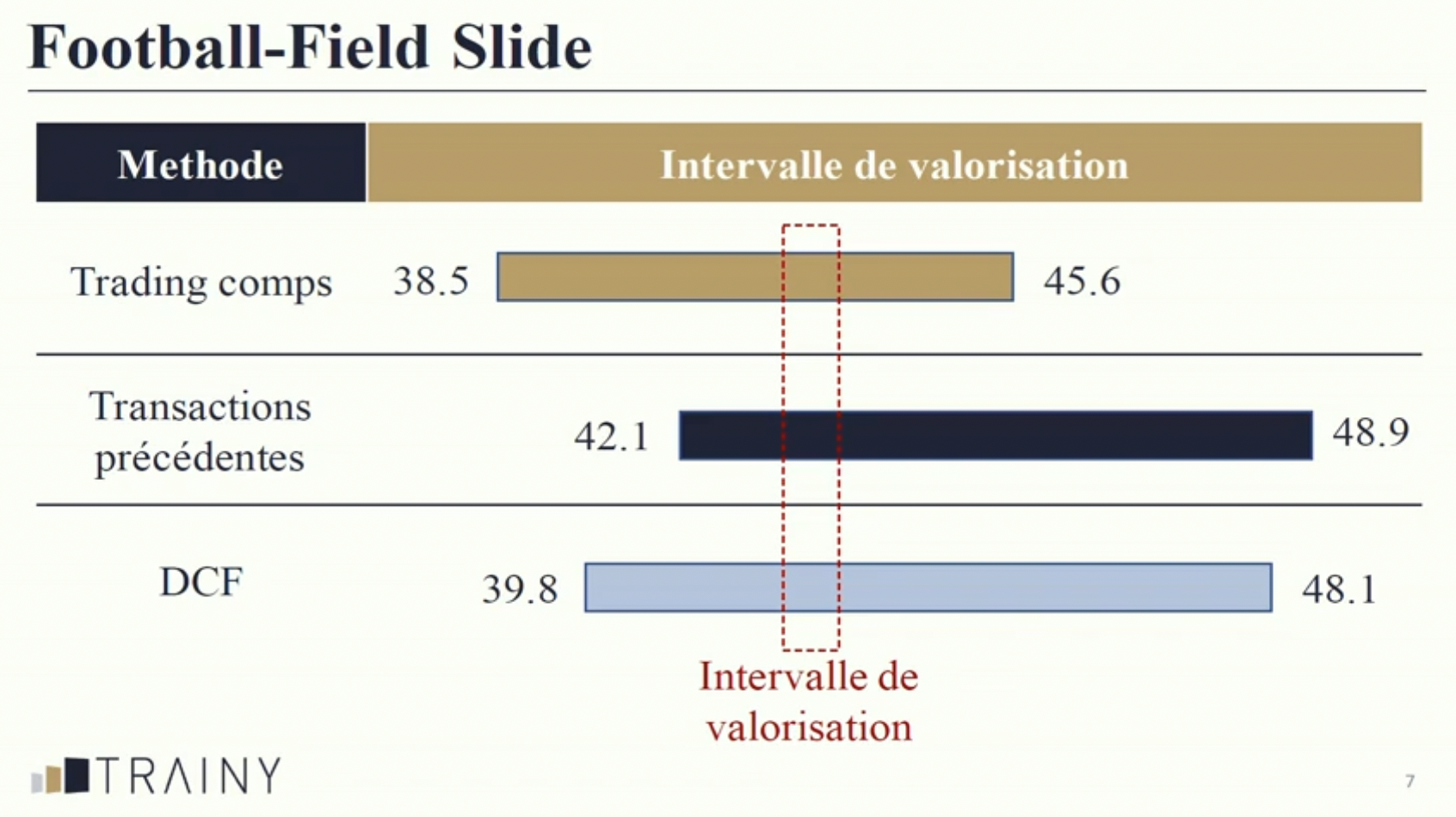

Each of these methods has a certain range of valuation since the data used may vary slightly depending on the methods used. For example, one can decide to use the median instead of the average of the comparable multiples in the Market Analysis method, one excludes a multiple, etc. To obtain a concrete range to present to his client, the investment bankers make a Football Field.

By grouping all the intervals determined during the different valuation methods, investment bankers manage to present the most accurate and appropriate interval to their clients.

Read more: M&A intern: assignments, recruitment and prospects